About us

CDO2 has developed a new technique for imaging the current flow in electric vehicle (EV) batteries. This is being used to enhance our understanding of battery cells so that manufacturers can improve cell performance and safety. Our work is partially funded by Innovate UK and the Advanced Propulsion Centre.

Technology

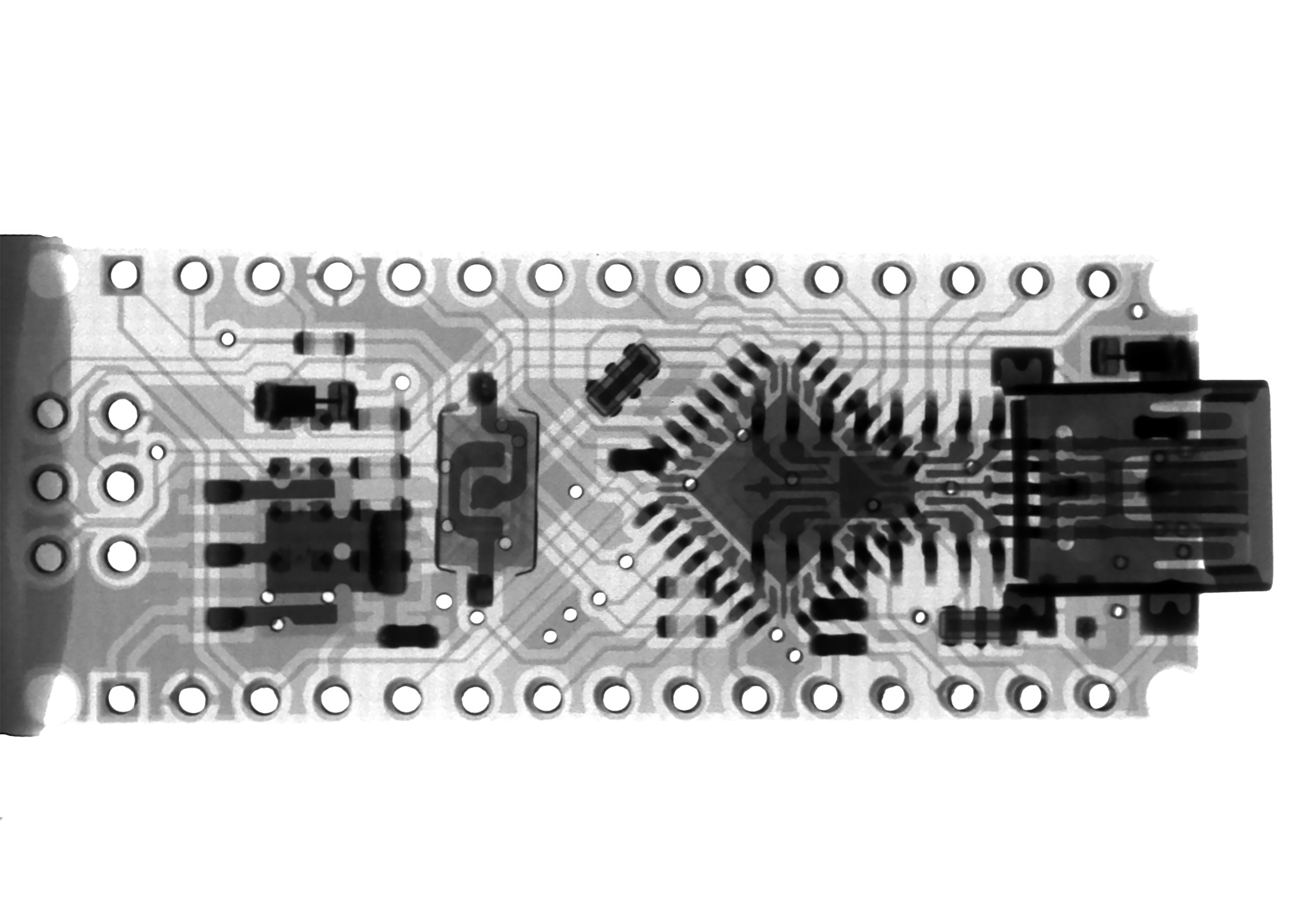

CDO2 is developing realtime current density imaging systems using classical and quantum sensors. Such systems are being used to measure the current flow inside EV batteries, helping estimate their charge and health and to detect faults early, significantly mitigating current EV battery safety concerns.

Contacts

Our offices and workshops are based in Sussex, in the South East of England.